MetLife Employee Benefit Trends

How Small Businesses Can Adapt to Workforce Transformation

4 min read

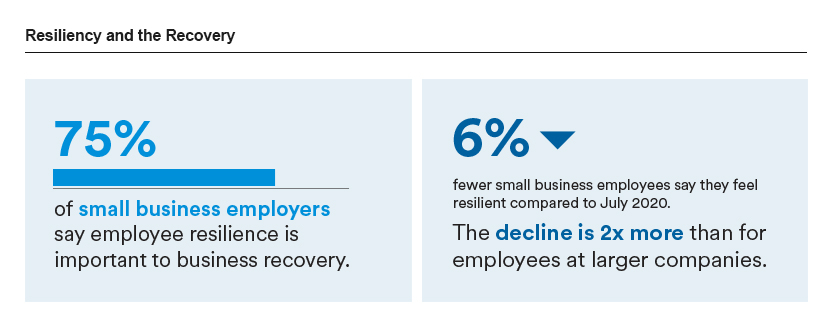

As the pandemic wanes and communities emerge from the restrictions, small businesses are once again calling upon the resilience of their employees to help drive the recovery. However, the dynamics of the work-life environment are changing.

MetLife's annual U.S. Employee Benefit Trends Study explores the perspectives of small business employers and employees to provide insights into evolving needs and priorities, along with practical steps small businesses can take to enhance the holistic well-being of their workforce.

Download StudyWhile small business owners recognize how important employee resilience will be for their recovery, they may underestimate shifting employee needs and expectations, as well as the critical role holistic well-being strategies can play in fostering a more resilient and productive workforce.

Here and Now: What Matters to Small Business Employers and Their Employees

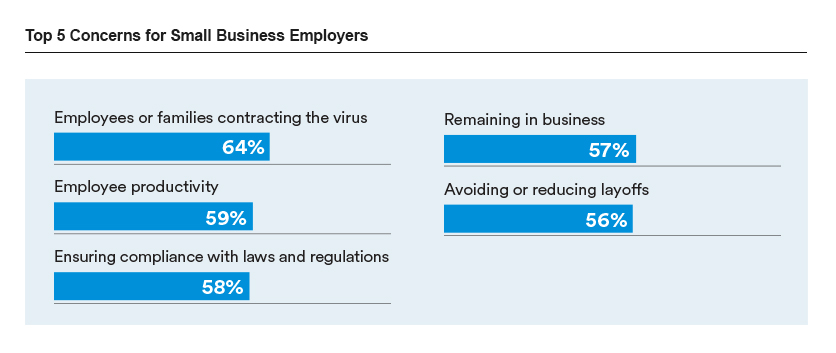

After months of dealing with the extraordinary challenges of the global pandemic and economic uncertainty, the MetLife and U.S. Chamber of Commerce Small Business Index found small business owners becoming more hopeful, with 65% saying the worst of the pandemic is in the past – up 21 points compared to December 2020. Still, 64% remain concerned about the impact of the pandemic on their business.

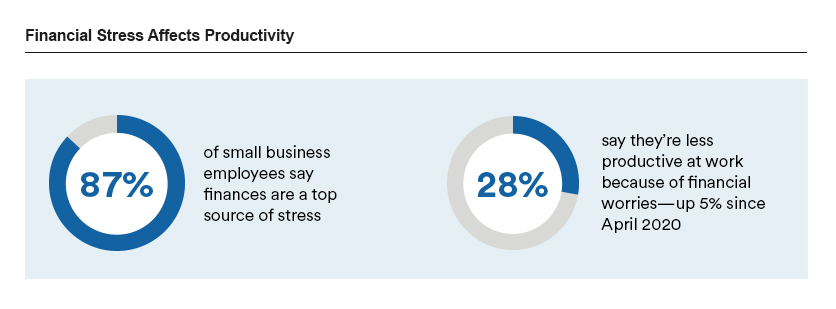

For small business employees, financial stress is a significant concern, with 87% citing their finances as a top concern both now and in the future.

Navigating the Recovery: The Strategic Role Benefits Can Play

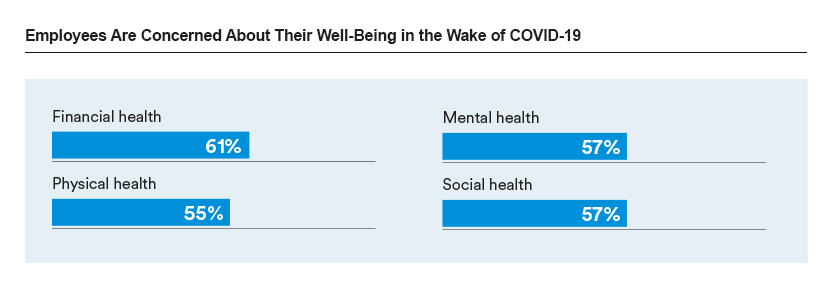

Financial health, along with physical, mental, and social health, represent the interconnected pillars of holistic well-being. More than half of small business employees are concerned with each of these categories. The shared concerns mean that employer strategies and programs addressing the spectrum of employee well-being are likely to have the most impact.

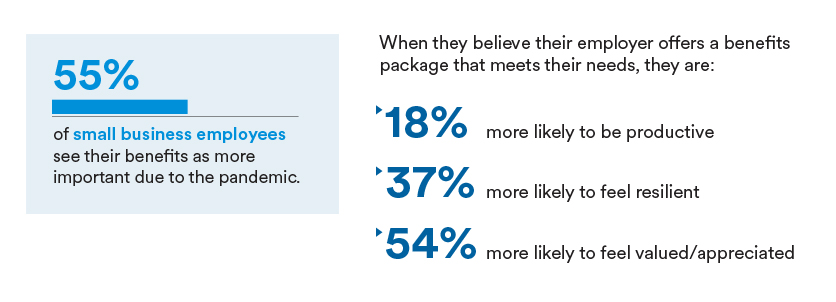

As employees look to their employer for greater support in lessening stressors and improving their holistic well-being, and small business employers take on the challenges of attracting and retaining the workforce they need, employee benefits can play a pivotal role.

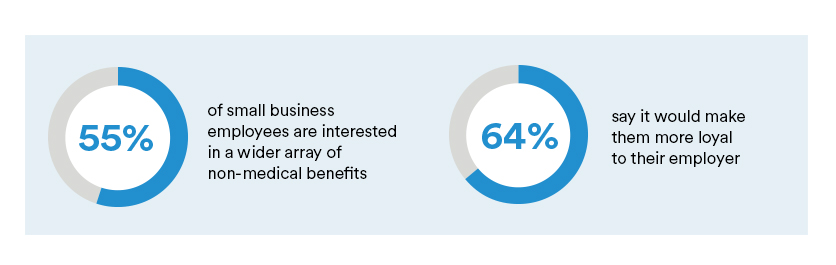

Going beyond the benefits basics doesn’t always require employers to invest significant money or time. Often, small businesses can enhance their benefits offering without increasing their budget by adding voluntary benefits that supplement medical insurance and retirement plans.

For employees, having access to a range of benefit choices they can choose based on their individual needs is an appealing and convenient way to address their well-being amid changing circumstances and protection priorities.

When it comes to the options employees are looking for, non-traditional voluntary benefits, like critical illness and hospital indemnity insurance, financial planning tools, health savings accounts, legal plans, and even pet insurance, are all trending upward on the small business employees’ “must-have” list.

Learn more about the must-have benefits for small businesses – and how they can help employers mitigate employee stress, improve retention, and navigate recovery.

Download the report for How Small Businesses Can Adapt to Workforce Transformation

Download The Full Report