Organizational Adaptability

Demonstrating care for Boomer employees calls for putting financial health first

Key takeaways

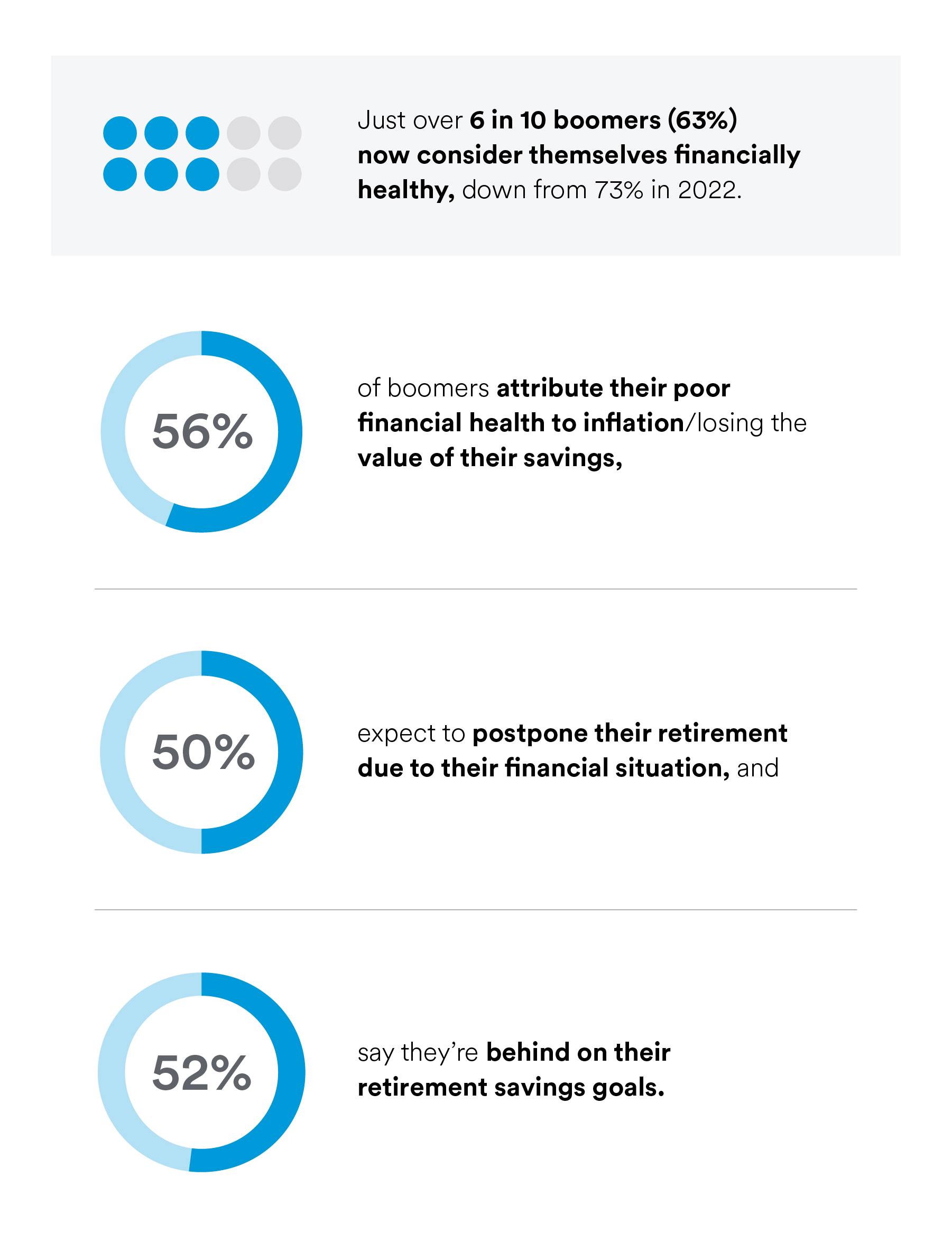

- Boomer employees’ financial health is on the decline amid concerns about inflation, medical expenses, and the cost of living in retirement.

- Employee care can boost Boomer employees’ financial well-being, while also increasing engagement and loyalty.

- Demonstrating care for Boomers requires offering affordable access to benefits, including financial wellness benefits, as well as providing purposeful work.

Demonstrating care for Boomers calls for putting financial health first

A year of rising interest rates and rampant inflation have placed new pressures on employees’ financial health. And Boomers, looking ahead to retirement just over the horizon, are finding cause for concern.

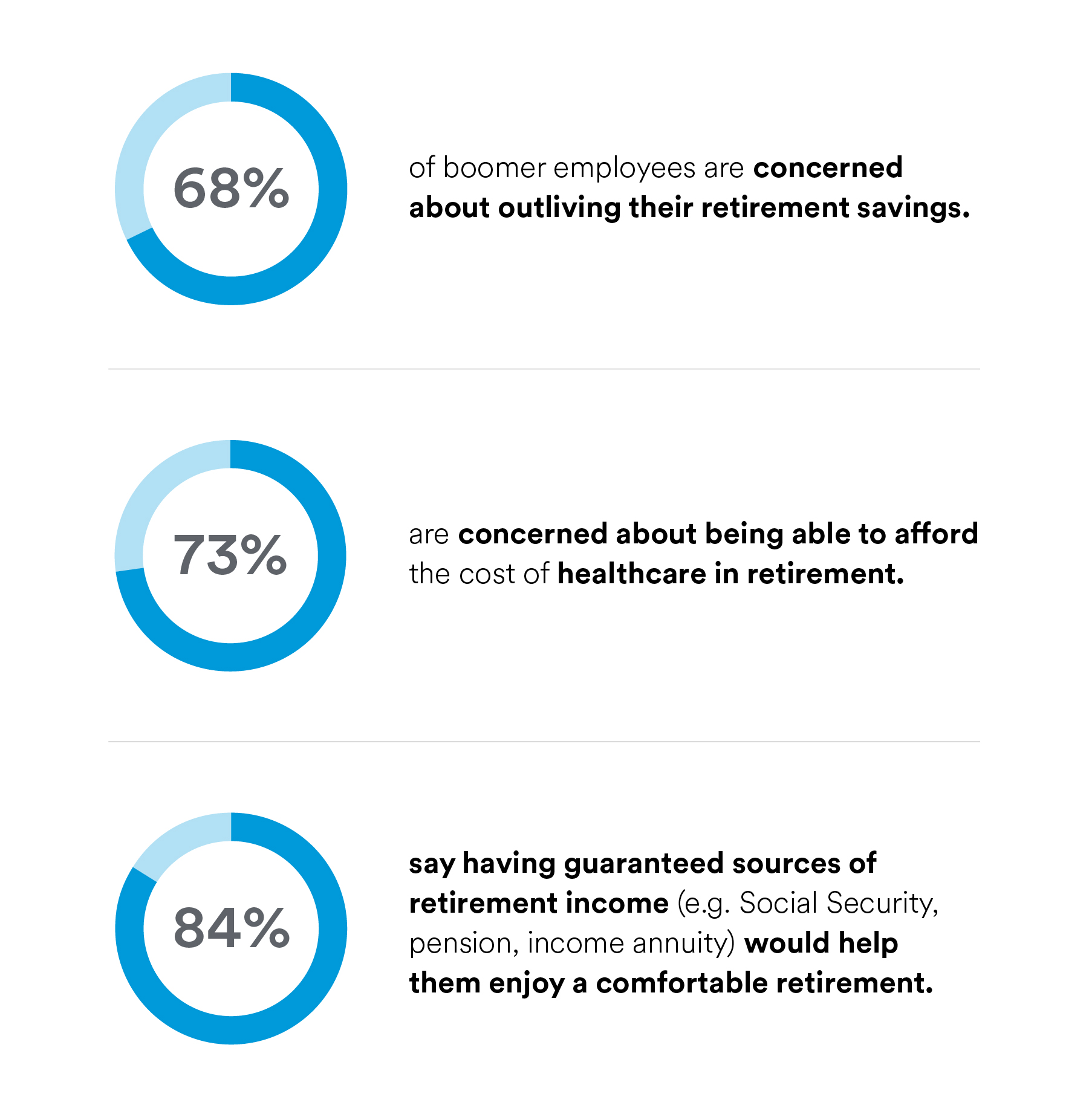

For Boomers, increased costs of living have stoked worries that they may outlive their retirement savings. And, in some cases, the disruption and uncertainties of the past few years have thrown their retirement plans off track.

Faced with these mounting financial pressures, Boomers are looking to their employers for help. And 80% of employers agree that they have a responsibility to help their workforce save adequately for retirement. Yet, the most direct solution — increasing compensation to help employees prepare for retirement — isn’t always possible, especially in a challenging macroeconomic climate.

Turning to care to support Boomers’ financial well-being

Rather than viewing compensation alone as the solution to Boomers’ financial concerns, employers should instead adopt a more holistic approach: demonstrating employee care.

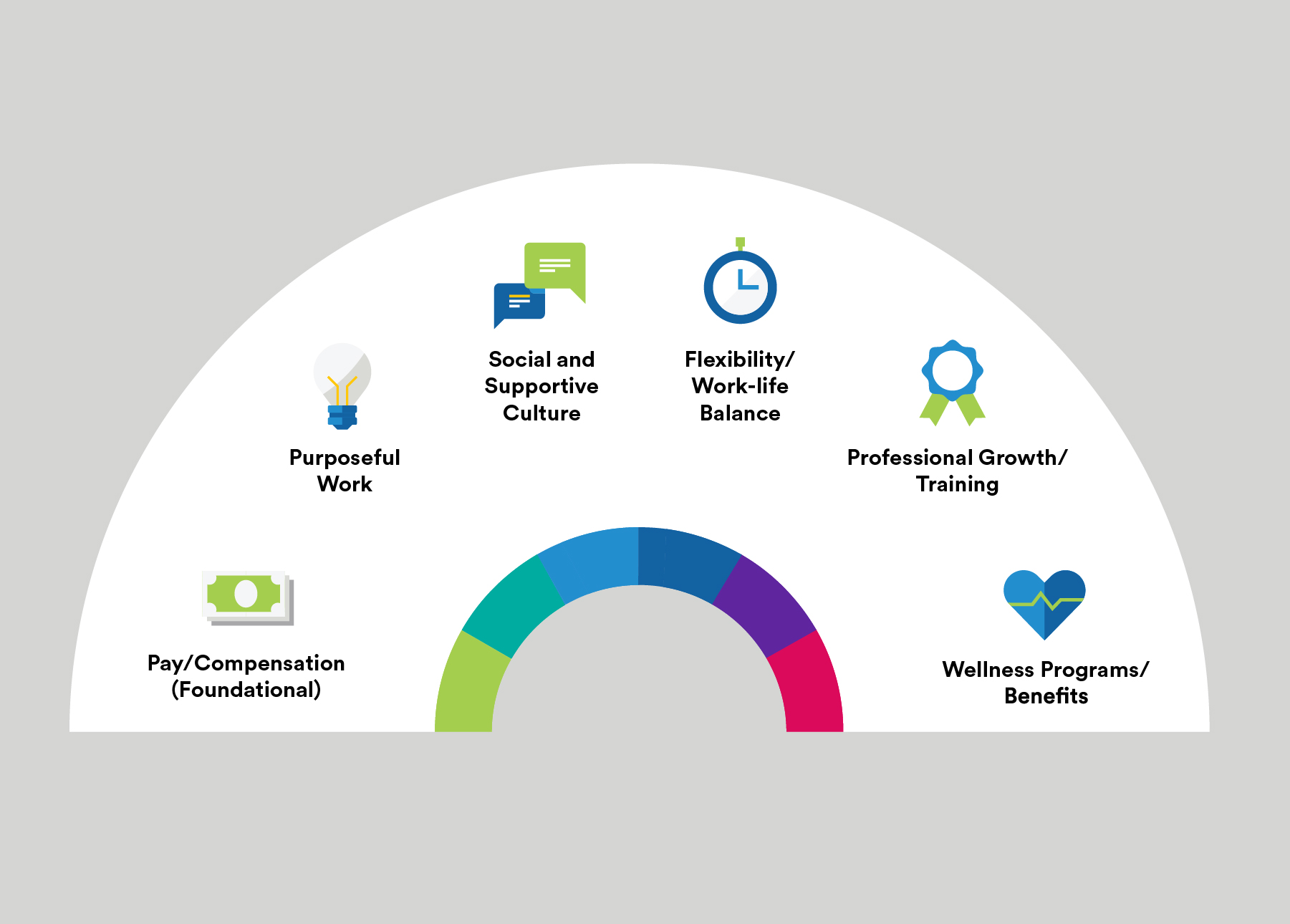

Employee care refers to taking a genuine interest in employees’ well-being, both at work and outside of work. It comprises five essential elements of the employee experience, as well as compensation. Together, these work synergistically to improve employees’ well-being — including their financial well-being — better than any one element alone.

Placed in the larger context of care, increases in compensation yield an even greater impact on Boomers’ financial well-being. And elements of the employee experience with fewer direct costs — for example, providing purposeful work — have a ripple effect that contributes to employees’ holistic health.

However, effectively demonstrating care requires a deep understanding of Boomers’ holistic well-being, and where they’re looking for employers to step in and help. Here, we’ll cover three strategies employers can use to deliver care to Boomer employees, strengthen the workplace culture and guide their workers toward a safe, secure retirement.

1. Focus on affordability for core wellness benefits and programs

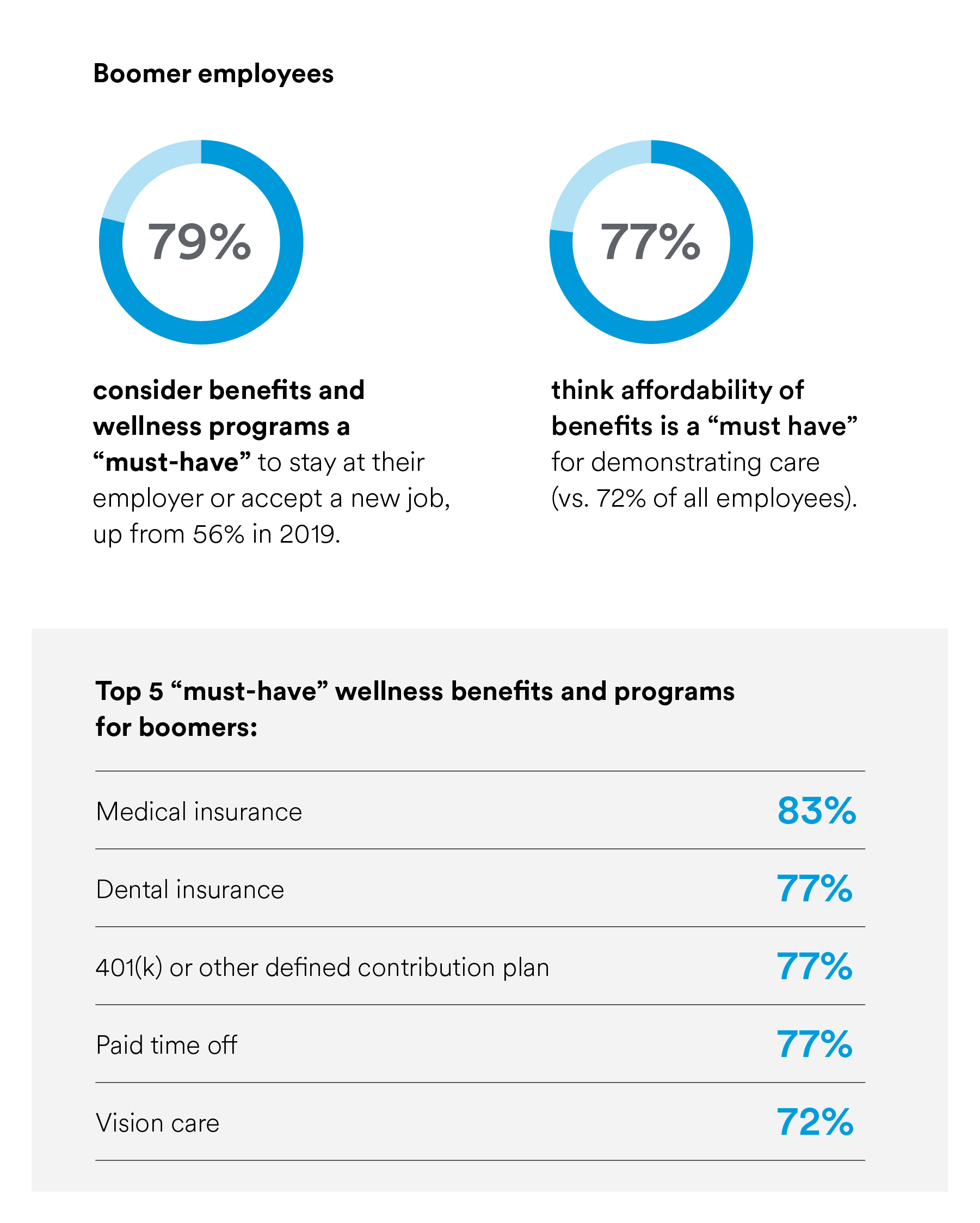

Wellness benefits and programs have traditionally been central to the employee experience — and that’s especially true amongst Boomers. Nearly three-quarters of Boomer employees say they’re concerned about healthcare costs in retirement, and, as a result, medical, dental and other healthcare benefits are top of mind.

However, Boomers aren’t simply seeking access to core benefits — they’re also looking for help covering their healthcare costs. Nearly four in five say the affordability of their benefits is a “must have” for demonstrating care — significantly more than younger employees. As a result, employers should explore opportunities to cover more of the cost of the wellness benefits and programs they provide.

In addition, employers should tailor benefits communications to Boomers’ financial concerns. Highlight benefits and programs with lower out-of-pocket expenses, and direct Boomers toward financial health benefits that may help them plan for the costs of accessing healthcare.

2. Offer a broader range of financial wellness benefits, including flexible retirement solutions

By and large, Boomers are most interested in core wellness benefits and programs — the “traditional” benefits that employers were already most likely to offer — rather than emerging benefits. However, just 51% of Boomers are satisfied with the financial wellness programs and benefits provided by their employer, creating an opportunity for employers to demonstrate care through a broader mix of financial wellness benefits.

As a baseline, four in five Boomers say access to a defined contribution retirement plan is a must-have. But Boomer employees also want benefits and programs that will support their continued financial well-being in retirement.

Employers should offer financial wellness benefits that help employees make the most of their defined contribution plan savings. Specifically, more than four in five (84%) of Boomers want the option to use some — or all — of their retirement savings to purchase an annuity that offers a guaranteed income stream in retirement.

3. Lean in on purposeful work

Although many Boomers are most focused on their financial health, mission-driven work remains an essential of employee care. Compared to the total workforce, Boomers are 10% more likely to say purposeful work is a “must-have” component of care, and 76% of Boomer employees are committed to their organization’s goals.

Employers can continue to ignite this sense of purpose by centering the organization’s larger mission in employees’ day-to-day tasks, and trusting employees to work in a way that feels most meaningful to them.

In addition, employers should invest in mentoring initiatives that allow Boomer employees to “pass on” this sense of purpose to the next generations of talent. Not only can experienced team members derive greater meaning from their work through teaching, but mentorship helps young talent develop new skills — a “must-have” to care for Gen Z.

Safeguard your employees’ future with care

With retirement just around the corner, Boomer employees seek additional support to ensure they can manage their cost of living, including their healthcare costs, in retirement. Taking a multifaceted approach to care allows employers to support Boomers’ holistic well-being, foster a happier, healthier workforce, and instill a sense of purpose that boosts outcomes across the organization.

MetLifes EmployeeBenefit TrendsStudy

GET THE REPORT

Methodology

MetLife’s 21st Annual U.S. Employee Benefit Trends Study was conducted in November 2022 and consists of two distinct studies fielded by Rainmakers CSI – a global strategy, insight, and planning consultancy. The employer survey includes 2,840 interviews with benefits decision-makers and influencers at companies with at least two employees. The employee survey consists of 2,884 interviews with full-time employees, ages 21 and over, at companies with at least two employees. This article contains data collected for but not reported in the primary report.